Click play to learn more about LDGMK Services

The biggest blunder any investor can make in real estate is to shop too early for money, yet this is the most common mistake we see investors making in real estate. The rule of thumb is it’s much easier to shop for cash when you have a deal in hand and under contract.

Why? Because as long as that property is not under contract, it’s up for grabs by anyone and everyone and no lender will spend time and resources on a property that can be snatched out from under the borrower at any moment’s notice.

Putting the house under contract is an easy enough, 4-Step process.

- Step 1: Prospect and Review Potential Properties

- Step 2: Write Offers

- Step 3: Get Offer Accepted by Seller

- Step 4: Put Earnest Money in Escrow to complete the contract.

Once these 4 Steps are completed, you have a fully executed Purchase and Sale Agreement, the property is under contract, and you are ready to shop for cash. If you’re ready to move forward and receive a term sheet, then fill out the form at the bottom of the page and we will get back to you within 24 business hours.

- It’s Fast: Flipping homes is a time-sensitive business. Depending on how fast you submit the loan package items, you can have your loan in several days to several weeks. It can take one to three months to secure a loan with traditional financing.

- It Looks at Collateral, Not You: Private money lenders are not interested in credit score. They are interested in how much value they see in the property since the property is the asset that is backing the loan.

- It’s Everywhere: Private money lenders are often people who have funds parked in lower-yielding financial vehicles like CDs, stocks, or IRAs and are looking for newer ways to maximize their funds in higher yielding conduits, like lending on real estate.

- It’s Creative: With Private money, you can get funding on great deals that banks would normally shun. Promising investment properties that need repairs, make them unsuitable for most banks, but perfect for most Private money lenders.

- It’s Flexible: Private money lenders don’t have the same strictly enforced guidelines to follow for their loan applications, so they are more willing to help creatively structure loans that work for the project.

Having a Private Money Lender, like LDGMK Capital in your court gives you confidence to put properties under contract. As long as you find the no-brainer deal that fits our guidelines, do the proper due-diligence, and turn in an application. you can be rest-assured that the deal will be funded!

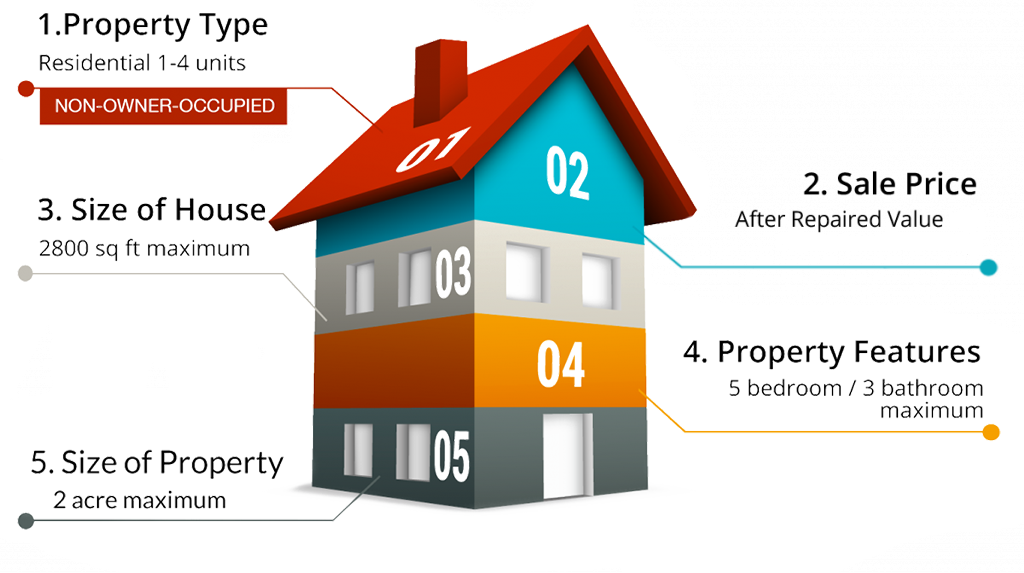

The first part of every successful fix and flip is finding the right real estate property. That’s why we’ve created this easy, 5-point guide to help you find the “sweet spot” deal, which can give you the best chance at making money in real estate, while safeguarding your investment.

At LDGMK Capital we are only interested in funding projects that will give you the best opportunity at realizing success. Therefore, our criteria is centered around these 5 points:

Homes above the FHA cap are statistically more likely to experience drastic fluctuations in value and can be more susceptible to local and overall market depreciation. Homes in the 5-point realm tend to be more resilient to these influences.

WHY 1-4 UNITS?

This is important. When you invest within these parameters, you can attract a larger segment of the market, including FHA buyers. This increases your ability to appeal to more people in more demographics.

WHY PRICE YOUR HOME AT OR BELOW FHA REQUIREMENTS?

FHA loans bring home ownership into reach for first-time home buyers who might have a hard time getting approved with conventional lenders. This increases your ability to sell your property faster and broadens your ability to attract more potential buyers.

WHY A SMALLER HOME WITH NO MORE THAN 5 BEDROOMS AND 3 BATHS?

Millennials and Boomers are the two segments expected to dominate the market in the next five years. Both of these segments are looking at smaller homes: Millennials because they’re just starting out; Boomers because they’re downsizing. Candace Taylor of The Wall Street Journal wrote, “These days, buyers of all ages eschew the large, ornate houses… in favor of smaller, more modern-looking alternatives.”

WHY LESS THAN 2 ACRE?

Both Boomers and Millennials are looking for less upkeep: Boomers because they’re getting older and Millennials because they’re just starting out. More acreage also means more expense.

Loan Terms

1. Max Loan Amount: Just Bring Us Your Deal! No cap on the loan amount if the numbers make sense. Rest assured; we will help you get it done. Call us today for more details.

2. LDGMK Capital has lending options from $30,000 up to the FHA Cap in the county where the property is located and can provide additional lending solutions based on the property you have under contract and type of loan needed.

3. Current rates start at 7.5% annualized interest with an origination fee from 0-5%, and no prepayment penalties. (Rates are based on credit score but credit score does NOT determine loan approval.)

4. Loan Term: 6 Months to 2 Years for a fix & flip. 30 Years for a buy & hold or refinance.

5. One loan approved per applicant until proven track record